Copyright © 2023 REPs Holdings Pte Ltd | Co. Reg. No. 201011096W. All rights reserved.

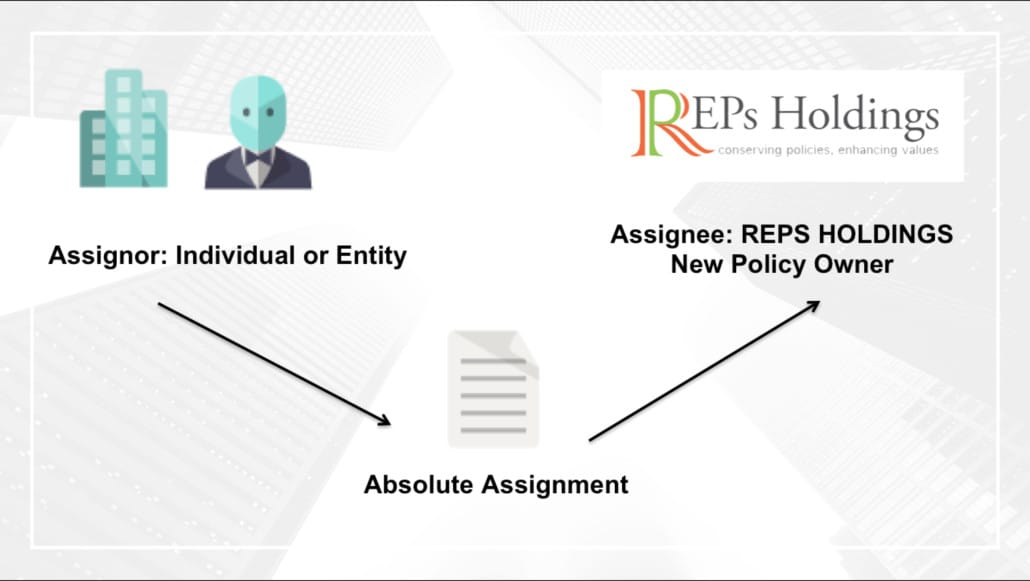

REPs Holdings (REPs Holdings Pte Ltd) is not licensed, approved, registered, or otherwise regulated by the Monetary Authority of Singapore or any other applicable regulator in Singapore or otherwise in respect of any of its activities, nor does it hold itself out as being so licensed, approved, registered or otherwise regulated. REPs Holdings does not hold itself out to be carrying on any activities which would require them to be so licensed, approved, registered, or otherwise regulated (including but not limited to regulated activities under the Securities and Futures Act (Cap.289) and financial advisory services under the Financial Advisors Act (Cap.110) of Singapore).