What Kind Of Insurance Policies Can Be Sold For Higher Value?

The market for resale insurance policies has been growing over the years. With greater understanding and knowledge that insurance policies can be sold for a higher value, more people are likely to sell their policies. However, it may be confusing on what kind of insurance policies can be sold for a higher value or cannot be sold at all, thus we will explore further on this topic to provide a better understanding!

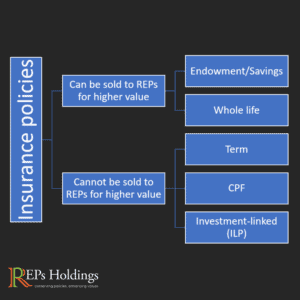

Type of Insurance Policies that can be sold to REPs for higher value

The fundamentals for policies to be bought over is that they must have cash value properties as these policies will generate returns over a period with premiums paid. Thus, Endowment/Savings and Whole Life policies are often sold to REPs.

Endowment/Savings policies

Endowment or Savings policies are often planned for children’s education, retirement, or wealth accumulation.

Whole life policies

Whole Life policies provide life-long protection and generally costs more as part of the premiums paid is invested to build up cash value. The accumulated cash value can be paid out in the event of unforeseen circumstances or encashed in old age if the protection amount is no longer needed.

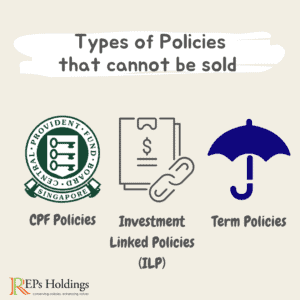

Type of Policies that cannot be sold to REPs for higher value

Term policies

Term policies have no cash value as premiums paid are only for protection. Such policies are Term Life, Personal Accident, Travel Insurance, and Car Insurance.

CPF policies

CPF policies are paid using our CPF money. Such policies are the Dependent Protection Scheme (DPS), MediShield Life, ElderShield, and CareShield Life.

Investment-Linked policies (ILP)

ILP are policies that can accumulate surrender/cash value with a combination of life insurance coverage. However, premiums paid into these policies are invested into specific funds that will meet your investment objectives and risk profile. Returns are also based on the fund’s performance. Thus, REPs do not take in such policies, as time and investment knowledge are needed to manage these policies.

If you have any Endowment/Savings policies or Whole life policies that you are looking to surrender and encash, feel free to contact REPs Holdings at 6221 4771 for a free policy valuation and quotation.